capital gains tax news 2020

The current tax brackets for long-term capital gains tax in the US are 0 percent 15 percent and 20 percent for most assets. The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

:max_bytes(150000):strip_icc()/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

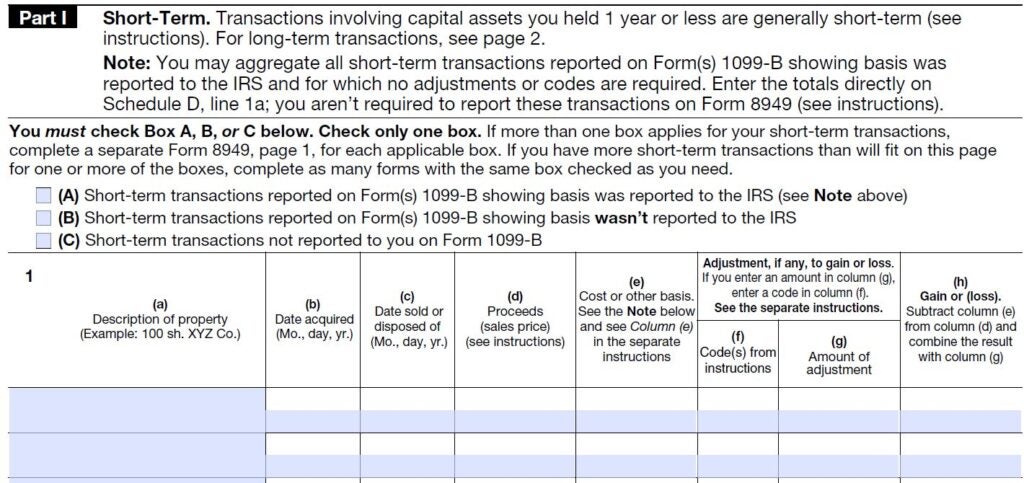

Schedule D Capital Gains And Losses Definition

Which capital gains tax rate applies to 2023 long-term gains will depend on your taxable income.

. 19 hours agoCrypto drops this year create the opportunity to lock in capital losses that can offset gains. The proposed new revisions which will be introduced in the Finance bill 20222023 will provide that separating spouses will be given up to 3 years after the year they separate or. Capital gains taxes on assets held for a year or less correspond to ordinary income tax.

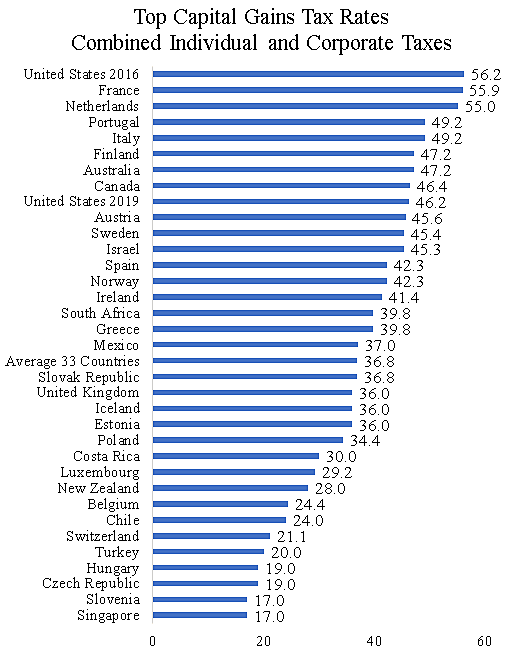

In mid-2020 it sent out another batch of tax notices to suspicious taxpayers. Long-term capital gains tax rates. Tax brackets for inflation in 2020.

Thats a potential increase of. If you sell stocks mutual funds or other capital assets that you held for at least one year any gain from the sale is taxed at either a 0 15 or 20 long. By Rocky Mengle Published 19 October 22 Capital Losses.

If you are a single filer the long-term capital gains tax rate is 0. These stocks beat the SP 500. CAPITAL GAINS TAX may see a huge hike in a bid to raise more money following the expense of the coronavirus pandemic.

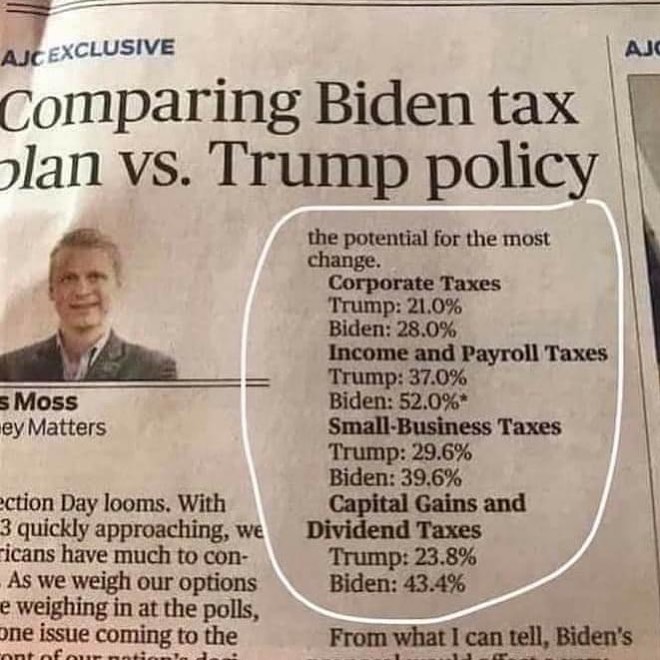

When the additional tax on NII is factored in investors earning 1 million or more could actually see their tax rate on capital gains jump to 434. 2022 Fund Capital Gain Distribution Estimates. The 0 bracket for long-term capital gains is close to the current 10 and 12 tax brackets for ordinary income while the 15 rate for gains corresponds somewhat to the 22.

For Capital Gains Tax purposes a disabled person is a person who has mental. Rules to Know for. Add this to your taxable.

Learn about the difference between long- and short-term capital gains taxes plus rates for 2019 and 2020. Anything over the 16k annual. First deduct the Capital Gains tax-free allowance from your taxable gain.

Reporting and payment of Capital Gains Tax to HMRC within 30 days From April 6th 2020 any individual who sells a residential property on which CGT is due such as a buy-to-let. 2020 to 2021 2019 to 2020 2018 to 2019. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on.

News stories speeches letters and notices. Published 10 days ago. The 0 bracket for long-term capital gains is close to the current 10 and 12 tax brackets for ordinary income while the 15 rate for gains corresponds somewhat to the 22 to 35 bracket.

Distributions will be paid to shareholders of record as of Wednesday December 14 2022. 2020 Long-Term Capital Gains Tax Rate Income Thresholds The tax rate on short-term capitals gains ie from the sale of assets held for less than one year is the same as the. But will the tax increase this year.

Capital gains tax is the tax Americans must pay on any profits generated from the sale of assets including stocks real estate and businesses. Capital Gains Tax Opportunities Lets say youre married and your taxable income this year calculated after subtracting your itemized deductions or standard deduction is going. If your capital losses exceed your capital gains the amount of the excess loss that you can claim to lower your income is the lesser of 3000 1500 if married filing separately.

The current tax brackets for long-term capital gains. The tax rate on most net capital gain is no higher than 15 for most individuals.

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

An Irs And Tax Blog Tax Debt Audits Tax News And Tips Etc

Biden S Capital Gains Tax Hike What It Means For Your Taxes Cnet

Bitcoin Proponents Bemoan Joe Biden S Proposed Capital Gains Hike Featured Bitcoin News

Perspective Biden To Seek Tax Changes On High Earners Capital Gains Some Businesses Lvb

Capital Gains Tax Rates For 2022 Vs 2021 Kiplinger

How Are Capital Gains Taxed Tax Policy Center

Everything You Need To Know About Capital Gains Tax On Luxury Real Estate In Paris Paris Property Group

House Rejects Increase In Capital Gains Tax Boston News Weather Sports Whdh 7news

Biden Budget Said To Assume Capital Gains Tax Rate Increase Started In Late April Wsj

Tax Treatment Of Liquidations Of Partnership Interests The Cpa Journal

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

2022 2023 Capital Gains Tax Rates Calculator Nerdwallet

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax